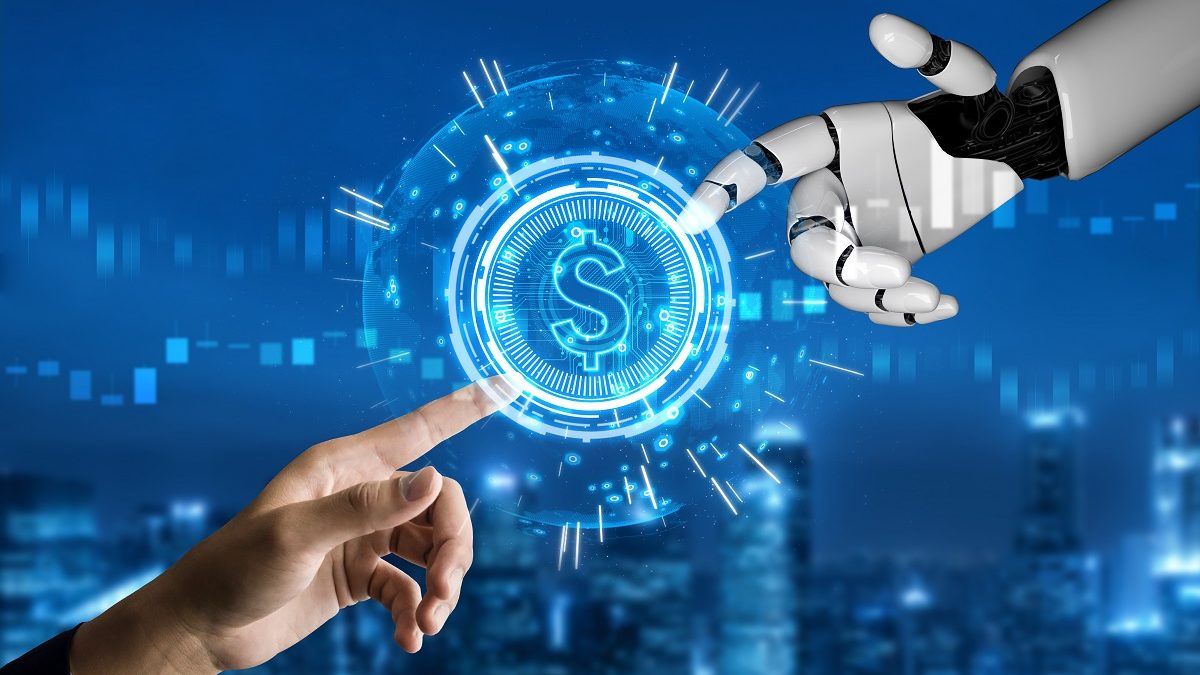

In the fast-evolving landscape of finance, Artificial Intelligence (AI) has emerged as a transformative force, reshaping traditional banking and investment practices, and unlocking new opportunities for efficiency, innovation, and risk management. From algorithmic trading to personalized banking services, the integration of AI technologies has revolutionized the way financial institutions operate and interact with their customers. In this comprehensive exploration, we delve into the multifaceted impact of AI in finance, tracing its evolution, examining its applications, and contemplating its implications for the future of the banking and investment sector.

The Rise of AI in Finance

The integration of AI in finance marks a paradigm shift in the way financial institutions leverage data, analytics, and automation to drive decision-making and enhance customer experiences. With the advent of big data and advancements in machine learning algorithms, financial firms can now analyze vast volumes of structured and unstructured data in real-time, extracting valuable insights and predictive patterns that were previously inaccessible.

From fraud detection and credit scoring to customer segmentation and portfolio optimization, AI-powered solutions offer unparalleled capabilities in mitigating risks, reducing costs, and maximizing returns across diverse areas of financial services. Moreover, the democratization of AI technologies has lowered barriers to entry, enabling startups and fintech disruptors to challenge traditional incumbents and drive innovation in the industry.

Transforming Banking Operations

In the realm of banking, AI technologies are revolutionizing operational efficiency, customer service, and risk management processes. Chatbots and virtual assistants equipped with natural language processing capabilities enable banks to provide round-the-clock customer support, streamline account inquiries, and deliver personalized recommendations tailored to individual needs and preferences.

Moreover, AI-driven algorithms empower banks to detect and prevent fraudulent activities in real-time, safeguarding customer assets and preserving trust in the financial system. By automating routine tasks such as data entry, reconciliation, and compliance reporting, AI enhances operational agility and frees up human resources to focus on value-added activities that drive business growth and innovation.

Enhancing Investment Strategies

In the realm of investment management, AI algorithms are revolutionizing portfolio construction, asset allocation, and risk mitigation strategies. Quantitative hedge funds and asset managers leverage machine learning models to analyze market trends, identify trading opportunities, and optimize investment portfolios with precision and agility.

Furthermore, robo-advisors powered by AI algorithms offer retail investors access to diversified investment portfolios tailored to their risk tolerance, investment objectives, and time horizon. By harnessing the power of predictive analytics and pattern recognition, AI empowers investors to make informed decisions and navigate volatile market conditions with confidence and conviction.

Challenges and Considerations

Despite its transformative potential, the widespread adoption of AI in finance presents a myriad of challenges and ethical considerations. Concerns regarding data privacy, algorithmic bias, and regulatory compliance loom large, raising questions about transparency, accountability, and the equitable distribution of benefits and risks.

Moreover, the rapid pace of technological innovation and the proliferation of algorithmic trading strategies amplify systemic risks and market vulnerabilities, necessitating robust mechanisms for risk management, stress testing, and crisis preparedness. As financial firms increasingly rely on AI-driven algorithms to automate decision-making processes, the imperative for human oversight, interpretability, and intervention becomes all the more critical to safeguard against unintended consequences and systemic failures.

Charting the Future of Finance

In charting the future of finance, a collaborative and interdisciplinary approach is essential to harnessing the transformative potential of AI while mitigating its inherent risks and challenges. Regulatory bodies, policymakers, and industry stakeholders must work together to establish clear guidelines, standards, and best practices for the responsible development and deployment of AI technologies in the financial sector.

Furthermore, investments in education, research, and talent development are imperative to fostering a culture of innovation, diversity, and ethical leadership in the finance industry. By prioritizing principles of fairness, transparency, and inclusivity, we can ensure that AI in finance serves as a catalyst for positive change, driving economic growth, financial inclusion, and sustainable development for generations to come.

Embracing the Promise of AI in Finance

In conclusion, AI in finance represents a transformative opportunity to reimagine banking and investment practices, empower consumers, and drive economic prosperity on a global scale. By harnessing the power of AI to unlock new insights, optimize decision-making processes, and enhance customer experiences, financial institutions can navigate the complexities of the digital age with confidence and foresight.

As we stand on the cusp of a new era of finance, let us embrace the promise of AI as a force for good, driving innovation, inclusivity, and sustainable growth in the banking and investment sector. By cultivating a culture of responsible innovation and ethical stewardship, we can chart a course towards a future where finance serves the needs of society, fosters prosperity, and advances the common good.

For more information contact : support@mindnotix.com

Mindnotix Software Development Company

AI-Taxi App

AI-Taxi App AI-Food App

AI-Food App AI-Property Mgmt App

AI-Property Mgmt App AI-CRM

AI-CRM AI-Fantasy App

AI-Fantasy App

Web Development

Web Development App Development

App Development Business & Startup

Business & Startup Hire Developer

Hire Developer

Digital Marketing

Digital Marketing Lead-generation

Lead-generation Creative Agency

Creative Agency Branding Agency

Branding Agency Augmented Reality

Augmented Reality Virtual Reality

Virtual Reality Internet of Things

Internet of Things Artificial Intelligence

Artificial Intelligence Blockchain

Blockchain Chatbot

Chatbot